We want to help you.

We want to help you.

US Debt Solutions is here for you. We want to assist with managing your debt before it gets out of control. We can help you navigate your creditors and debt and ease the burden, stress one feels when life puts you in a tough spot.

Who we are

Who we are

US Debt Solutions, LLC is a debt solutions provider targeting consumers subpoenaed to appear in court for non-payment of delinquent debt(s). Our service seeks to provide relief from litigation of delinquent credit card and personal debts through negotiating reduced debt settlements with the plaintiff’s attorney. The service begins with a consultation with one of our Client Managers to better understanding the client’s unique situation. Whether their financial picture has been negatively impacted by a loss of employment, mounting medical bills, separation, divorce, death of a spouse, tax levies, or other life altering causes, we can assist with settling their credit card and personal debts after they have been served with a notice to appear in court.

How are we different

How are we different

As U.S. consumer debt balloons to an all-time high, people are looking for solutions. As a way out, some consumers have turned to debt settlement companies, which claim to help people gain control of their finances when they have fallen behind on payments. But the tactics often used by these companies can put consumers in greater debt and harm their credit scores. If you have considered a debt settlement company, here is what you should know about the process and its risks.

How US Debt Solutions Works

US Debt Solutions, LLC is a debt solutions provider targeting consumers subpoenaed to appear in court for non-payment of delinquent debt(s). Our service seeks to provide relief from going to court for delinquent credit card and other unsecured debts for an average fee between 8-10%. We will negotiate a reduced debt settlement with your creditor’s attorney or collection agency.

The service begins with a consultation with one of our Debt Settlement Representatives to better understand your unique situation. Whether your financial picture has been negatively impacted by a loss of employment, mounting medical bills, separation, divorce, death of a spouse, tax levies, or other life-altering causes, we can assist with settling the credit card and personal debts after you have been served with a notice to appear in court by your creditor.

How Debt Settlement Companies Works

Debt settlement companies are sometimes touted as an alternative to bankruptcy. Also called debt relief or debt adjustment companies, these companies promise to negotiate with your creditors to reduce your debt for an average fee of 22%. Typically, the debt settlement companies will not accept you if you do not have $10,000 in credit card or other unsecured debt. In addition, you are ineligible for their services if you have been subpoenaed by a creditor to appear in court for an unpaid debt.

When you contact a debt settlement company, they will generally ask for the names of your creditors and the amounts that you owe. Then, they will give you an estimate for a new, lower monthly payment. The fees for their services are embedded in the new, lower monthly payment at an average fee of 22%. The debt settlement company will also typically advise you to stop paying your creditors and to send payments to an escrow account set up at their company which may add additional fees. Next, the debt settlement company will contact your creditors to try to get them to accept a smaller amount and write off the rest as bad debt. The bad debt written off by the credit card company could also result in your receiving an IRS notice reflecting the charged-off debt as income.

There are Risks to Debt Settlement

This process presents several risks to you, starting with the debt settlement company telling you to stop making payments directly to your creditors.

The main risk is your credit score is likely to take a hit. Because you are not paying your bills, missed payments will be reported to credit agencies which will likely have a negative impact on your credit score. During this time, you will likely also rack up late fees, interest, and other penalties.

Debt settlement companies use this tactic as a way to make creditors believe that, if they do not accept the lower amount, they might get nothing.

There is also a chance the debt settlement company will not be able to settle all of your debt. Some of your creditors could refuse to work with the debt settlement company or may not agree to reduce the debt. Your creditor may even send your debt to a collection agency or file a lawsuit against you.

Even if the debt settlement company is able to settle all or most of your debt, the fees, interest, penalties, and hit to your credit score might not be worthwhile. According to the U.S. Consumer Financial Protection Bureau, debt settlement may leave you in even deeper debt than before you tried to settle.

Debt is becoming an increasingly common challenge. Knowing your options could help put you on the path to financial security. Identify a company whose representatives you can trust and discuss your options before making any big decision. It is not a sign of weakness to seek help.

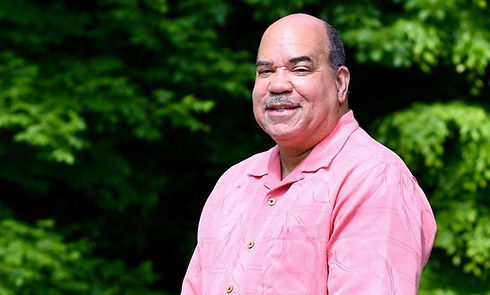

Trent Williams, Founder

Trent Williams, Founder

As a multi-faceted operational, financial, and revenue growth executive and leader, Trent Williams provided the drive and skill critical to ongoing success for companies facing tough business conditions. He is skilled in operationalizing strategy and tenacious in achieving challenging goals. He maximized profitability and built operational and financial systems fundamental to top performance.

As an executive-level professional, Trent Williams has been trusted with overseeing regional operations and driving performance that exceeded targets for revenue growth, profitability, and customer loyalty for some of the world’s leading financial institutions, including Wells Fargo, Wachovia, and Bank of America.

Mr. Williams is practiced in deep strategic financial thinking, and experienced in ensuring that strong operational, administrative, and financial controls are in place. He turned strategic thinking into a key productivity and profitability driver. Trent offers a proven ability to integrate quickly and productively into new businesses with new rules. He guided organizations through mergers and economic recessions, and in each case, always maintained his razor-sharp focus on ensuring that clients remained a top priority.

Trent has been described as a natural leader, forward-thinking strategist, inspiring motivator, astute analyst, persuasive communicator, and exceptional relationship builder. He thrives on challenges and works well in fast-paced, high-pressure environments. Leading by example, he balances empowerment and accountability to foster innovation, continuous improvements, and organizational excellence at all levels.

Trent is an active philanthropist and community leader. He served in numerous leadership positions and board member.

I'm here to help you. Please use the form below if you need me.

It takes a village, let us be apart of your village.

It takes a village, let us be apart of your village.